AA Ireland Report Finds Major Jump In Cost of Running a Home

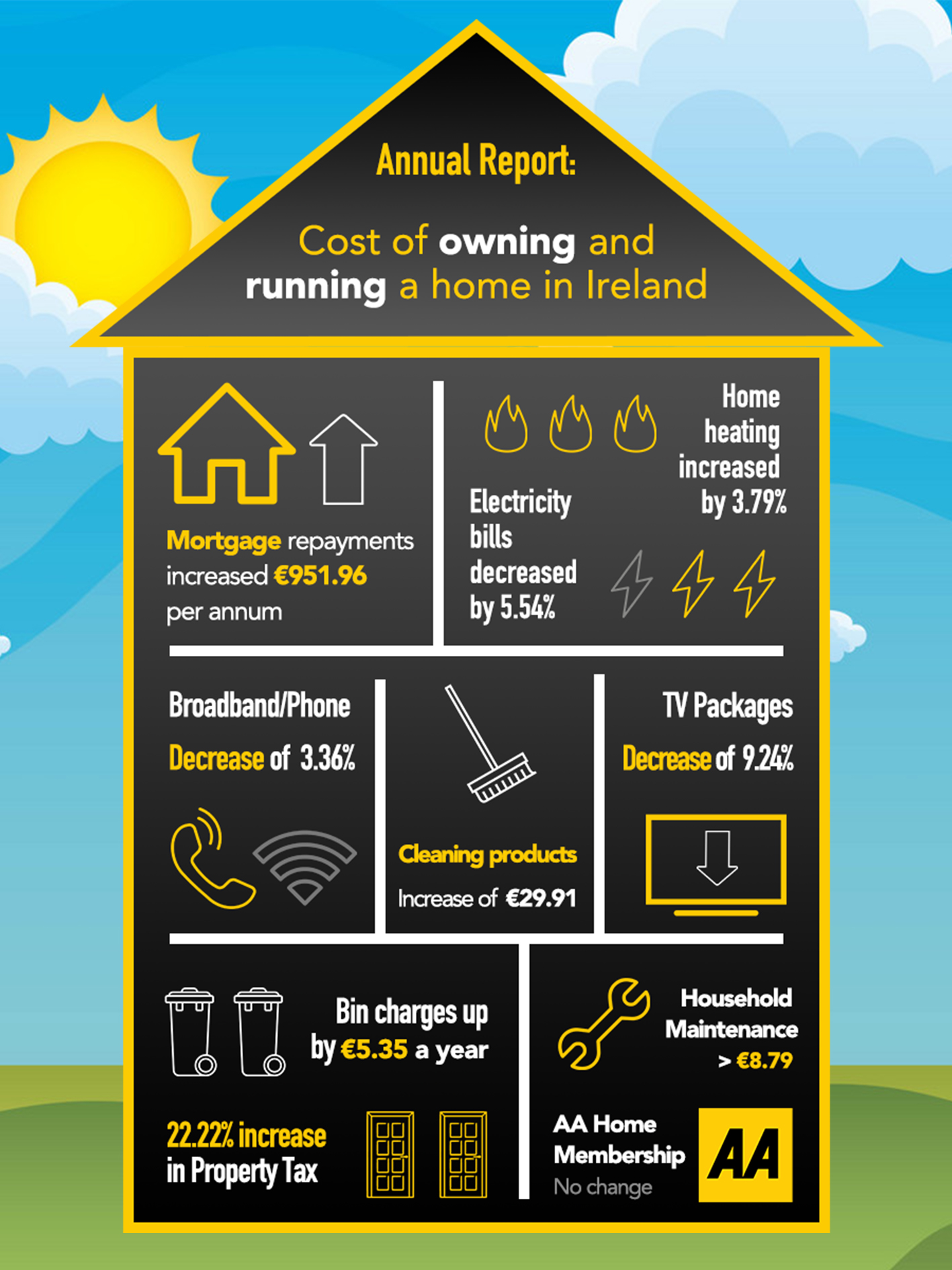

- The cost of owning and maintaining a home in Ireland has risen to €17,393.25 per annum, an increase of over €1,000 compared to 2018.

- Average property asking price rises by over €25k from €243,000 in 2018 to €269,000 this year.

- Increase in mortgage repayments key driver behind increase in home running costs.

The annual cost of owning and maintaining a family home has risen by over €1,000 per annum according to the latest ‘Cost of Running a Home’ analysis from AA Home Insurance, with the average homeowner now spending over €17,000 on owning and maintaining their home.

Research undertaken by the insurance intermediary has found that the cost of running a home in Ireland comes to €17,393.25, a significant increase from last year’s calculation of €16,374.45. The AA’s latest findings means that the cost of owning and maintaining a home equate to approximately 43.4% of the current average Irish national wage[1].

The AA carries out a detailed calculation each year which looks at the total cost of owning a house and subsequently running one in Ireland. Mortgage and property tax are calculated based on the current average property price. All other expenditure – from broadband to heating, to the cost of domestic appliances – is researched and calculated according to prices as of October 2019.

The increase in the cost of running a home comes following a rise in the national average price of a second hand home in Ireland. Values increased from €243,000 during the third quarter of last year to €269,000 in the third quarter of this year – an increase of €26,000. This increase in the cost of acquiring a home has caused a significant increase in mortgage repayment costs, the main driver behind the increase in home ownership costs.

According to the AA’s calculations, those who took out a 90 percent mortgage this year are likely to pay €11,021.04 per annum in mortgage repayments – an increase of 9.45% on last year.

“While we’re still significantly off the peaks seen during the Celtic Tiger, house prices have continued to surge in the past 12 months representing a major issue for both those looking to acquire their first home and those trying to meet their monthly mortgage repayments. In fact, the increase in monthly mortgage repayments almost single-handedly accounts for the over €1,000 increase in home running costs that we have seen this year,” Conor Faughnan, AA Director of Consumer Affairs stated. “The good news is that many of the other increases seen in home running costs are offset by drops in the cost of electricity and broadband/tv charges, meaning if you were fortunate enough to purchase your home when prices were lower, your financial situation is largely unchanged.”

“Overall, the percentage of the average national wage which must be put aside to cover these costs has increased by slightly by almost 1.5%, something which will be a major concern for families across the country. This is particularly true for those trying to get their foot on the property ladder, who are facing many of the costs associated with home ownership, whilst also trying to meet rental payments and save for a deposit,” Faughnan added. “If you look at both housing prices and home running costs as measured by the AA over the past 5 years, annual costs have increased by almost €2,000 with house prices increasing by over €60,000. This is certainly a worrying and unsustainable trend and highlights the need for urgent action by Government and local councils to ensure the housing stock isn’t outstripped by demand.”

While the AA bases its calculations on those of a new buyer, there is also the ‘negative equity generation’ – homeowners who bought their house at the peak of the boom. The AA gives figures for that group too, assuming the house is bought in 2007. That group currently pays €4,653.48 more on their mortgage repayments than their counterparts who purchased their homes in the third quarter of this year.

Maintenance, repair and contingency funds is the second single most expensive bill for Irish householders and has increased by 0.7% on 2017. The AA estimates that the average homeowner is likely to spend or set aside €1,264.35 each year to keep up with wear and tear. This figure equates to slightly over 7 percent of the overall estimated cost of owning and running a home.

Taking annual average usage figures of 11,000 kWh and 4,200 kWh for a three or four bedroom detached house respectively, the AA estimates that the average homeowner will spend €815.72 (+3.79 percent) heating their home this year and a further €999.79 (-5.54 percent) on electricity.

Among the variables that remained the same as or close to last year were television licence costs at €160, the cost of home appliances, and AA Home Membership at €125.88.

Other costs included in the AA Home Insurance study were: i) home insurance (building and contents combined) which is calculated at about €570.95, ii) telephone and broadband bills at €420, iii) household appliances at €554.86, iv) household cleaning products at €340.94, v) domestic refuse collection at €300.72.

Illustration: Average cost of owning and running a home through the years:

| Year of purchase and national average property value | Average cost of running a home

(costs today assuming year of purchase as shown) |

| 2007 for €344k (then av. national house price) | €21,344.08 |

| Q3 2015 for 205k (current av. national house price) | €15,431.41 |

| Q3 2016 for 215k (current av. national house price) | €15,876.45 |

| Q3 2017 for 224.5k (current av. national house price) | €16,006.62 |

| Q3 2018 for 243k (current av. national house price) | €16,374.45 |

| Q3 2019 for 269k (current av. national house price) | €17,393.25 |